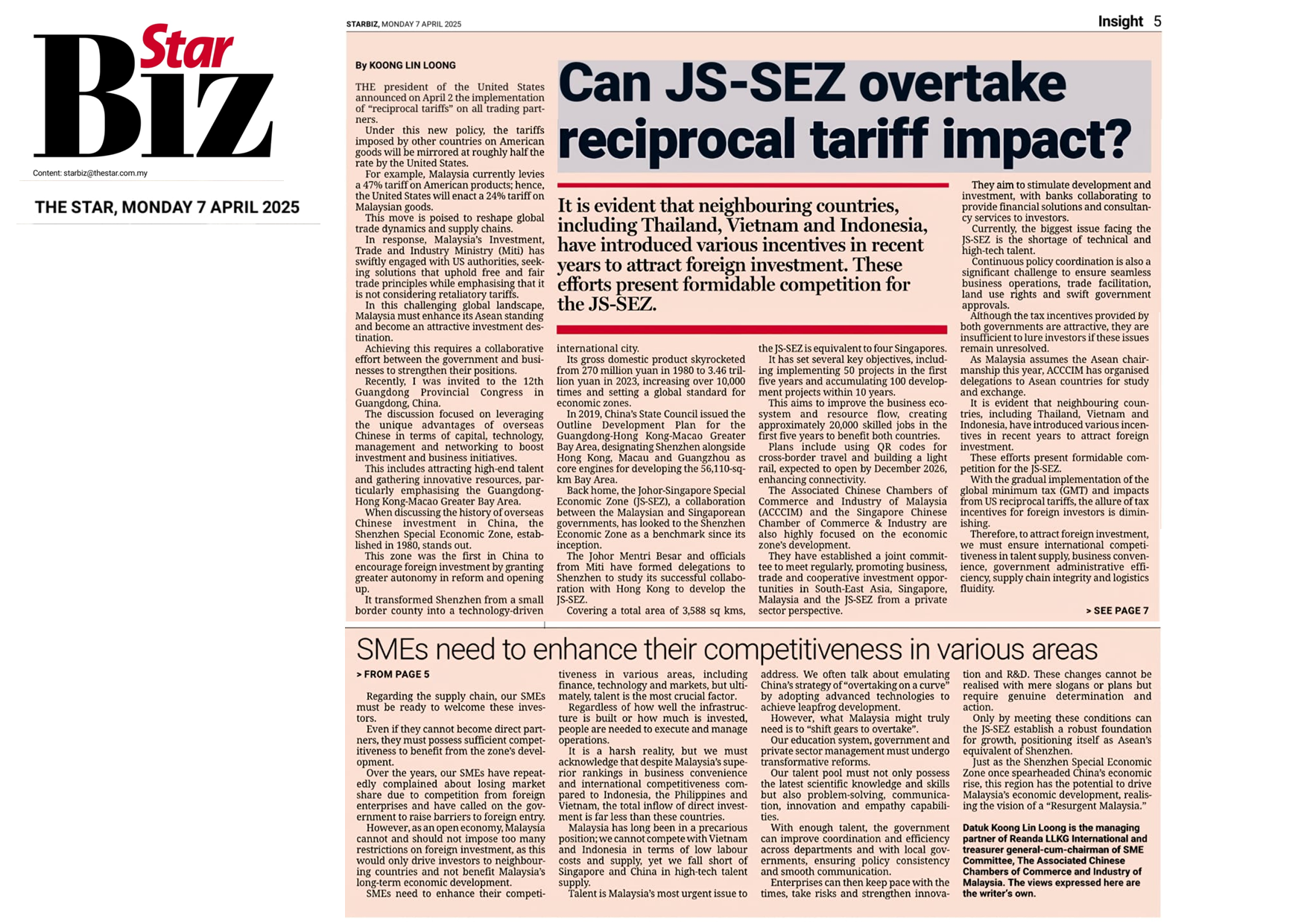

We often talk about emulating China's strategy of "overtaking on a curve" by adopting advanced technologies to achieve leapfrog development. However, what Malaysia might truly need is to "shift gears to overtake." Our education system, government and private sector management must undergo transformative reforms. Our talent pool must not only possess the latest scientific knowledge and skills but also problem-solving, communication, innovation and empathy capabilities. With enough talent, the government can improve coordination and efficiency across departments and with local governments, ensuring policy consistency and smooth communication. Enterprises can then keep pace with the times, take risks and strengthen innovation and R&D. These changes cannot be realised with mere slogans or plans but require genuine determination and action.

Reanda Malaysia

Empowered by knowledge

Reanda Malaysia

Empowered by knowledge

Insights

Our Views

Are you ready for e-invoicing starting Aug 1?

The RM150,000 annual turnover threshold is too low, likely exempting only a small number of traders. Instead of covering most unprepared micro-enterprises, which could disrupt the market, increase consumer costs and cause inflation, it's better to raise the threshold to RM500,000. This will allow capable enterprises to implement e-invoicing first before the IRB gradually expands it to lower turnover businesses, say RM300,000 and RM150,000 before covering all businesses. This phased approach will give the IRB time to solve initial technical issues and allow businesses and consumers to gradually adapt.

Implementing E-Invoicing Does Not Mean Changing Accounting Software

First and foremost, it is crucial to understand that implementing e-invoicing does not necessarily require changing your accounting software in many cases. If a software supplier claims that you must replace your entire accounting software to link with the Inland Revenue Board's (IRB) MyInvois system, then what you need to do is change your supplier instead.

Wishful longing in the new year of the wood dragon

Let’s hope that the Malaysian economy and everyone's fortunes can align with this greeting and embark on a new journey in harmony with the cycle of Period Nine fortunes. May we soar like dragons, with a bright future, abundant lives and successful careers!

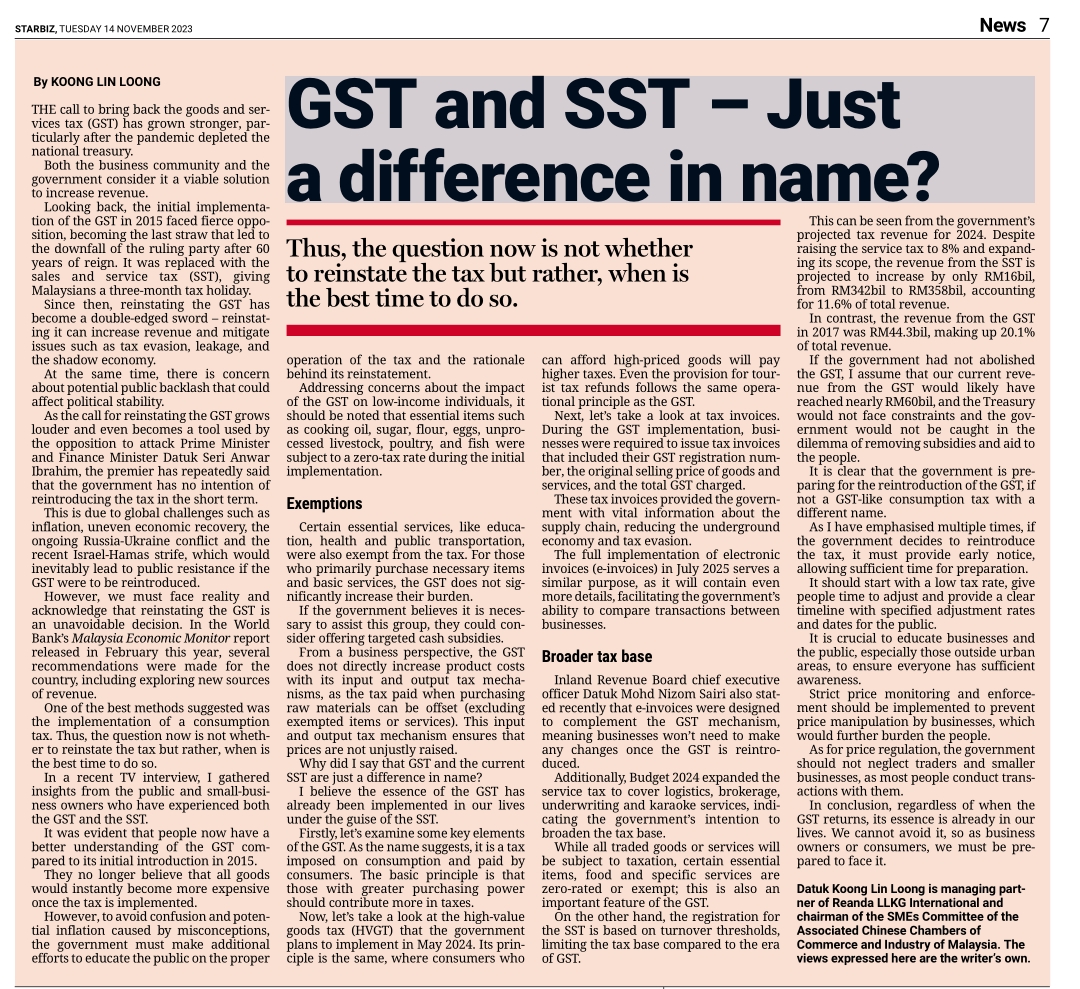

GST and SST – Just a Difference in Name?

Regardless of when the GST returns, its essence is already in our lives. We cannot avoid it, so as business owners or consumers, we must be prepared to face it.

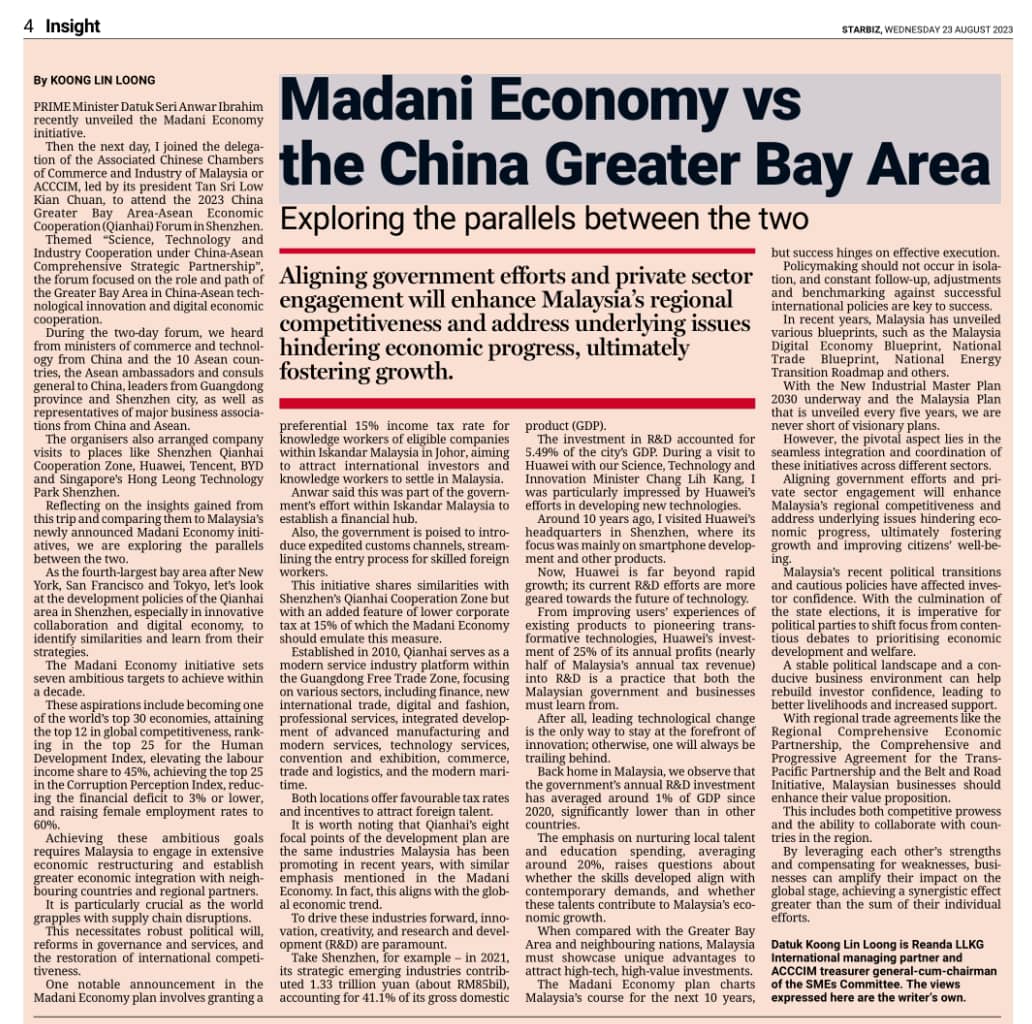

Madani Economy vs the Greater Bay Area - Exploring the Parallels Between the Two

Aligning government efforts and private sector engagement will enhance Malaysia's regional competitiveness and address underlying issues hindering economic progress, ultimately fostering growth and improving citizens' well-being.

More business-friendly Policies to attract investors

The Prime Minister's recent visit to China yielded record investment deals of RM170bil, proving to be a fruitful albeit short trip. We hope that the RM170bil investment can be put into action quickly to stimulate the economy.

New PM, New Cabinet, New Hope

We know that when the economy improves, people's livelihoods will naturally improve, especially in terms of rising prices. Besides, the political situation will also stabilise. So, it is of utmost importance for the new governments to stabilise and revive the economy and restore the confidence of foreign and local investors.

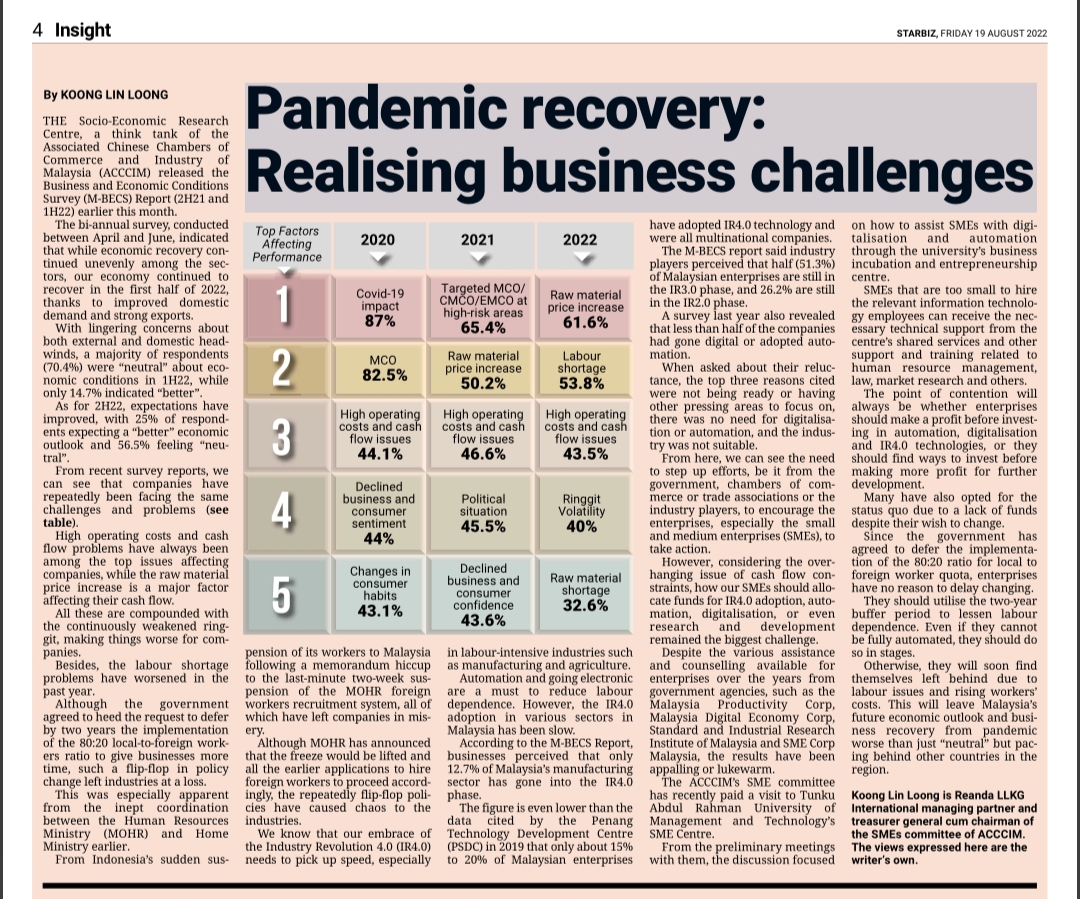

Pandemic Recovery – Realising Business Challenges

High operating costs and cash flow problems have always been among the top issues affecting companies, while the raw material price increase is a major factor affecting their cash flow. All these are compounded with the continuously weakened ringgit, making things worse for companies.

Covid-19 Impact: Is Digitalisation the Only Way Out?

We must not regard digitalisation as the sole objective, as it is just a supporting tool, one that helps us improve the quality of our products or services, increase efficiency, reduce manpower or help make the delivery process to customers more smoothly.