Customs DG T Subromaniam says this is to address the disparity between foreign companies operating in Malaysia under the digital economy and local players who are subjected to the tax.

Reanda Malaysia

Empowered by knowledge

Reanda Malaysia

Empowered by knowledge

News

Budget 2018 – Lower income and corporate taxes?

LLKoong: tax rate on chargeable income up to the first RM500,000 should be reduced to 17% from the current 18%.

More funds for small businesses

BUDGET 2018 maintained a strong emphasis on SMEs as industry observers note a bigger allocation for the sector compared with 2017. However, many also note that a cut in corporate tax was sorely lacking.

Improved taxation structure vital for bilateral

FTA An improved taxation structure with emphasis on a more business-friendly environment by the government is vital for the country before proceeding with any bilateral free trade agreement (FTA).

To Catch a Conman~the Edge

There is a new breed of opportunist known as the grantpreneur who specialises in obtaining grants under false pretences... see the story covered by the Edge...

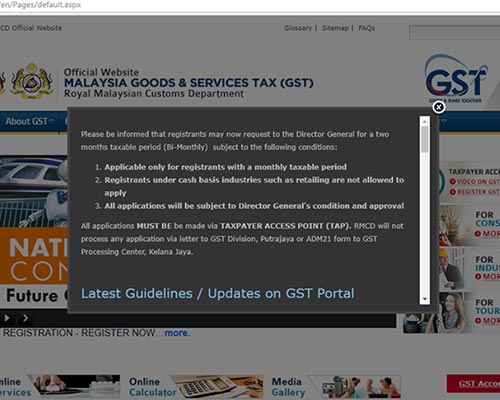

BIG NEWS FOR GST!

All registrants may now request to the Customs Director General for 2 months taxable period (Bi-monthly) subject to the following conditions:

10 Clues Will Alert LHDN to Investigate Tax Evaders in Malaysia

Contrary to popular assumption, the Internal Revenue Department (LHDN) doesn't just go after wealthy titled individuals as seen in the recent investigation of several Tan Sris and Datuk Seri over tax evasion.

WITHHOLDING TAX IN MALAYSIA

Withholding tax is an amount withheld by the resident carrying on business in Malaysia on income earned by a non-resident and paid to the Inland Revenue Board of Malaysia.